Estate planners have been expecting sweeping changes to the estate tax laws for some time now as a way to pay for increased spending. Dropping the Federal estate tax exemption to a much lower level is usually at the top of the list. Many reliable, time-tested estate planning options are also rumored to be eliminated at some point. These include stepped-up basis at death, family limited partnerships, charitable trusts, grantor trusts, qualified personal residence trusts, dynasty trusts, discounted values and other methods frequently used in estate, business succession and asset protection planning.

But with the Republicans in charge of the House, and the Democrats holding the Senate and the White House, it is unlikely that any major changes will happen this year.

So, for now, the estate laws remain the same. The top capital gains tax is still 20% on assets held for more than 12 months. Federal estate tax exemptions and annual tax-free gifts have increased again in 2023, giving you the opportunity to transfer more wealth tax-free. The new amounts are found below.

Federal Estate Tax

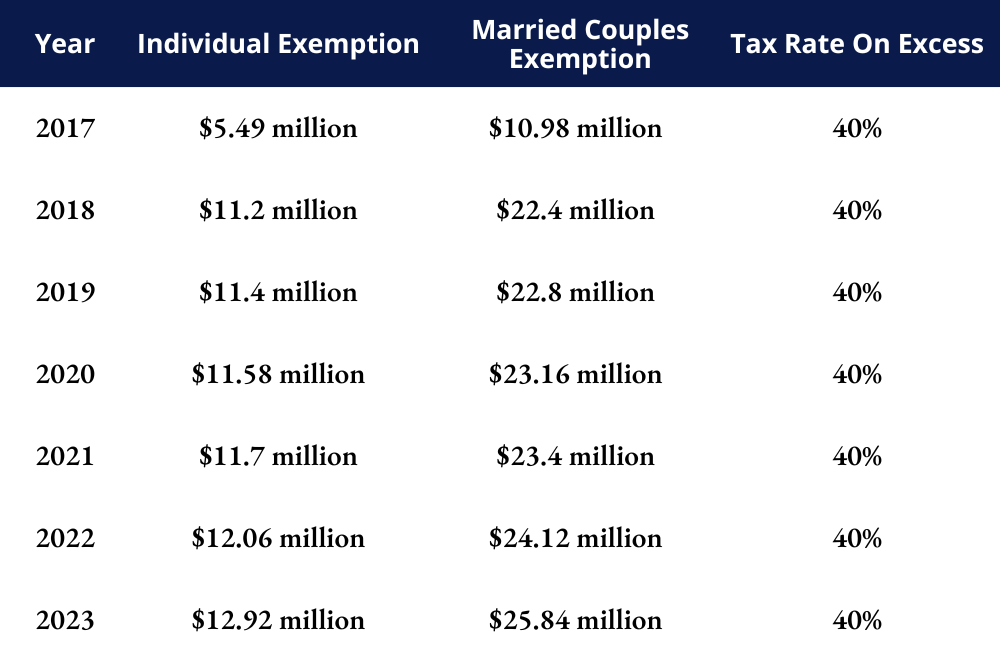

The Tax Cuts and Jobs Act, signed into law by President Trump on December 22, 2017, did not eliminate the Federal estate tax, as many expected. But it did double the exemption, from $5.49 million for individuals and $10.98 million for married couples in 2017 to $11.2 million for individuals and $22.4 million for married couples in 2018. The exemption continues to be tied to inflation, so it will be adjusted each year…until the end of 2025. If Congress does nothing before then, the estate tax exemption will return to the 2017 rates ($5 million, adjusted for inflation). The tax rate for assets over the exempt amount remains at 40%.

Here are the Federal estate tax exemptions for recent years:

Generation Skipping Transfer (GST) Tax

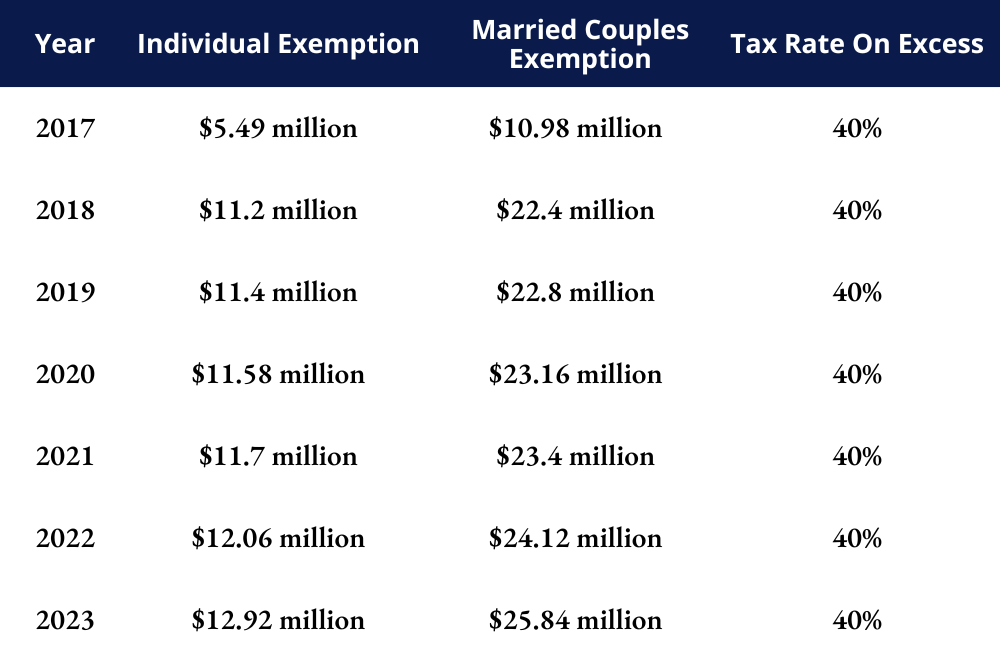

The GST tax applies to assets you leave that “skip” a generation. For example, if you leave assets directly to your grandchildren, bypassing their parents, you may have to pay a GST tax. It also applies to assets you leave to other individuals more than 37 1/2 years younger than you. The reason it exists is that Uncle Sam wants his share of taxes, just as if each generation had received its inheritance and paid the taxes on it. The GST tax is in addition to the Federal estate tax and is equal to the highest estate tax rate in effect at that time (currently 40%).

The good news is that everyone has an exemption from the GST tax. It is the same as the Federal estate tax exemption and it, too, is adjusted annually for inflation. Also, if Congress does not act by the end of 2025, the GST exemption will return to the 2017 rates ($5 million, adjusted for inflation).

Here are the Federal GST tax exemptions for recent years:

What This Can Mean to You and Your Estate Planning

Your estate will not have to pay Federal estate taxes if its net value (assets minus debts) is less than the exempt amount in effect at the time you die. Estimates are that the current Federal estate tax exemption rescues all but about 2,000 families from the dreaded Federal estate tax. So, for most families, this means you are free to plan your estate without having to jump through hoops to avoid estate taxes. But keep in mind that this increase is currently temporary— if Congress does not act before 2026, the exemption is set to revert to 2017 rates, adjusted for inflation.

Estate Planning Tips

Here are several reasons to review your existing estate plan with your attorney—or to finally make this the year you have your estate planning done.

Beneficiary Designations for IRAs and Other Tax-Deferred Plans—If you have not yet reviewed beneficiary designations for your IRAs and other tax-deferred accounts with your attorney, this should be at the top of your estate planning review list. Stretching out distributions over a beneficiary’s life expectancy has been eliminated for most beneficiaries. Funds from inherited IRAs and other tax-deferred accounts must now be fully withdrawn, and all income taxes paid, within ten years of the account owner’s death.

There are exemptions for certain beneficiaries: 1) surviving spouses can still use the spousal rollover option and name a new beneficiary (who would be subject to the 10-year-rule when your spouse dies); 2) your minor child (whose 10-year payout period starts when the minor legally becomes an adult); 3) a chronically ill and disabled beneficiary (who must meet stringent requirements); and 4) beneficiaries who are not more than ten years younger than the account owner.

If your trust beneficiary meets the requirements to be exempt, your attorney can help you with the best way to use your tax-deferred account(s) to provide for that beneficiary. Other planning options are also available. For example, naming a trust as beneficiary will give you the most control over the proceeds and protect them from a beneficiary’s creditors and irresponsible spending. Life insurance can be used to pay the income taxes. A charitable remainder trust, a viable option for larger accounts, is exempt from income taxes and can pay your beneficiary a lifetime income.

Keeping Documents Updated for Current and Future Exemptions—Your estate plan may have been written so that an amount equal to the federal estate tax exemption goes to your children or grandchildren and the balance to your surviving spouse. With the increased exemption, this could cause a larger than intended amount to go to your children/grandchildren and a smaller than intended amount (or even zero) to your spouse. Your attorney may also want to plan for a possible reduced exemption in 2026 or sooner.

Planning for State Taxes—Some states have their own estate/ inheritance tax, often at a lower threshold, so your estate could be exempt from the Federal estate tax, but still have to pay a state tax. Your attorney can help you reduce or eliminate these taxes.

Income Tax and Asset Protection Planning—Instead of estate tax planning, your attorney may want to concentrate on income tax and/or asset protection planning.

Take Advantage of Increased Exemptions—If your estate is larger, you will want to take advantage of the increased exemptions while we have them. If you have previously used your exemptions for transferring assets during your lifetime, you now have increased exemptions and can make additional tax-free transfers and gifts.

Business Succession Planning—If you are a business owner, make sure you have a business succession plan in place for your retirement, potential incapacity, and eventual death.

Charitable Gift Planning—Increased appreciation on assets provides an excellent opportunity for charitable giving if you are so inclined.

Have you met with our Trust & Investments Department recently? We can help you make wise investment choices and estate decisions that suit your personal goals and lifetime planning objectives. We’ll work closely with your attorneys, accountants and other key advisors for a coordinated and highly personalized approach.

Contact us for a no-obligation discussion on how we can address your needs. (603) 430-2955 or e-mail trustdept@piscataqua.com.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Back to News and Insights